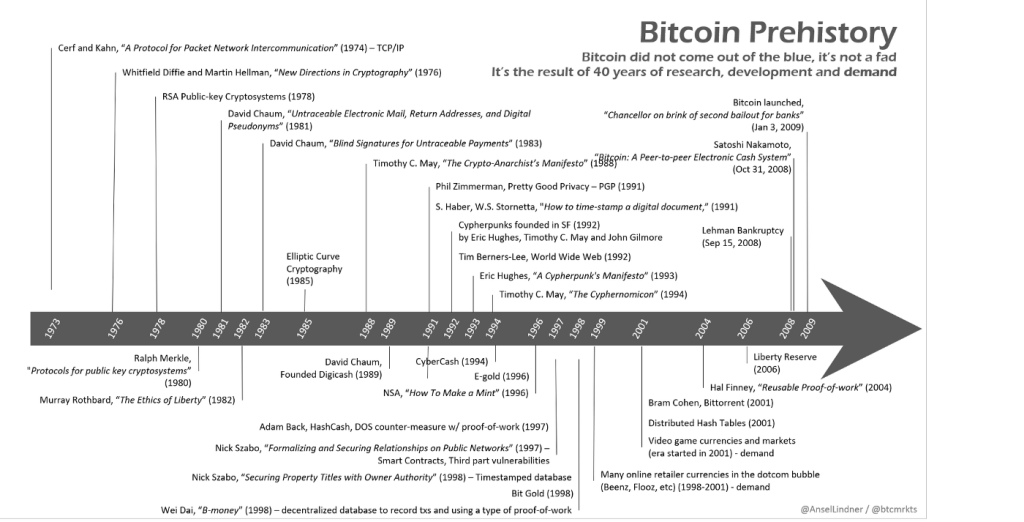

A Boulevard of Broken Coins: Pre-Bitcoin History

The concept of cryptocurrency was first proposed in the late 1980s, with the goal of creating a currency that could be sent anonymously and without the use of centralised entities (i.e. Banks). Many concepts developed by Bitcoin’s predecessors are still used in the protocol. Luckily, Bitcoin has been able to solve fundamental problems that others could not, most notably: the double-spend problem, the byzantine general’s problem, transactions with traditional banks, payments, and long-term storage feature (a wallet).

DigiCash (David Chaum) – 1989

The invention of Blind Signature Technology is credited to David Chaum. Chaum wrote a paper in 1982 at the University of California, Berkeley, explaining the technological developments in public and private key technology that led to the development of Blind Signature Technology. Chaum’s Blind Signature Technology was created to ensure that users doing online transactions are completely anonymous. Chaum was concerned about the public nature of internet payments and personal information, as well as unrestricted access to it. He then recommended creating a system of cryptographic protocols that would make it impossible for a bank or the government to track personal payments made online. Through Chaum’s startup, DigiCash, this technology was fully deployed in 1990.

Before it could be delivered to a destination, DigiCash was a type of early electronic payment that required user software to withdraw notes from a bank and select certain encryption keys. Electronic payments are now untraceable by the issuing bank, the government, or a third party thanks to advances in public and private key encryption. Through the issue of encrypted keys, this technique of Blind Signatures through DigiCash software improves security for its users, preventing third parties from accessing personal information through online transactions. The Mark Twain Bank in Missouri, which was later bought by Mercantile Bank, was the only bank in the United States that supported DigiCash technology. The second bank to back DigiCash systems was Deutsche Bank, based in Germany.

Failed: unable to expand its userbase or solve “double spend”

DigiCash was unable to properly expand its user base in order to grow the company. In a 1999 interview, Chaum noted that the DigiCash project and technological system were introduced to the market before e-commerce was fully incorporated into the Internet. DigiCash filed for Chapter 11 bankruptcy in 1998, and the company was sold for assets in 2002. Taler Systems SA provides a more current implementation of the DigiCash concept as Free Software with the “GNU Taler” protocol.

Szabo was unable to solve the double-spending problem (digital data can be copied and pasted) without the use of a central authority, and the history of Bitcoin, and subsequent cryptocurrencies, did not begin until a decade later, when a mysterious person or persons, using the pseudonym Satoshi Nakamoto, published a white paper titled Bitcoin – A Peer to Peer Electronic Cash System.

Mondex (National Westminster Bank) – 1993

The Mastercard Mondex is a smart card electronic cash system that is implemented as a Mastercard stored-value card.

Tim Jones and Graham Higgins of the National Westminster Bank in the United Kingdom came up with the idea for Mondex. The technology was initially created between 1990 and 1993, with internal trials conducted by roughly 6,000 NatWest employees in London beginning in 1992. The technology was first shown to the public in December 1993. [1] The newly established Mondex International in Swindon, Wiltshire, conducted the first public trials of the payment system in July 1995. The public phase necessitated the creation and manufacture of multiple merchant devices and smart cards, with BT, NatWest, and Midland Bank sponsoring and placing retail terminals at parking lots, payphones, buses, and 700 of the city’s bus stops the merchants in the town and issuing Mondex cards to the residents.

In 1992, Ron William, then-CEO of Europay International and prior executive for Natwest’s Mondex team, brought the concept and technology developed by Natwest to the attention of Europay International and MasterCard International executives. Visa and MasterCard agreed to the terms of the West Side Trial in 1997. Visa and MasterCard tested their electronic purses, Visa Currency and Mondex, to determine if residents of the selected locality on Manhattan Island would accept the concept and technology as a way to replace cash. At the same time, other financial institutions, telecommunications companies, and governments participated in Mondex International and became shareholders.

Failed: was not interoperable with current technology systems

Mondex had become entrapped in a vicious cycle. It was a “closed-loop” card, meaning you could only use it with a particular reader in a few places. It couldn’t be used in Visa or Mastercard machines, which were utilised by the majority of merchants. As a result, it failed to reach critical mass, and stores did not invest in expensive equipment.

CyberCash (Lynch, Melton, Crocker & Wilson) – 1994

CyberCash, Inc. was a Reston, Virginia-based internet payment service for electronic commerce. Daniel C. Lynch (chairman), William N. Melton (president and CEO, subsequently chairman), Steve Crocker (Chief Technology Officer), and Bruce G. Wilson formed the company in August 1994. Consumers may use the company’s online wallet software, and retailers could use it to take credit card payments. Later, they added “CyberCoin,” a micropayment system based on Carnegie Mellon University’s NetBill research project, which they later licenced.

The US government had imposed a temporary ban on the export of cryptography at the time, making it unlawful to provide encryption technology outside the country. The Department of State granted CyberCash an exemption after determining that it would be easier to construct encryption technology from scratch than to extract it from CyberCash’s software.

RFC 1898, CyberCash Credit Card Protocol Version 0.8, was proposed by the business in 1995. The firm went public with the symbol “CYCH” on February 19, 1996, and its shares gained 79 per cent on the first day of trading. In 1998, CyberCash acquired ICVerify, a provider of computer-based credit card processing software, and in 1999, they added Tellan Software to their portfolio. In January 2000, a teen Russian hacker known as “Maxus” claimed to have cracked CyberCash’s ICVerify application; the company denied this, claiming that ICVerify was not even used by the allegedly compromised company.

Failed: recorded incident of double-spend

Many customers of CyberCash’s ICVerify application were affected by the Y2K Bug on January 1, 2000, resulting in a double recording of credit card payments through their system. Despite the fact that CyberCash had already produced a Y2K-compliant upgrade, many users had not updated it.

On March 11, 2001, the company filed for Chapter 11 bankruptcy protection. A few months later, VeriSign purchased the Cybercash assets (excluding ICVerify) and name. PayPal (an eBay firm) bought VeriSign’s payment services, including Cybercash, on November 21, 2005.

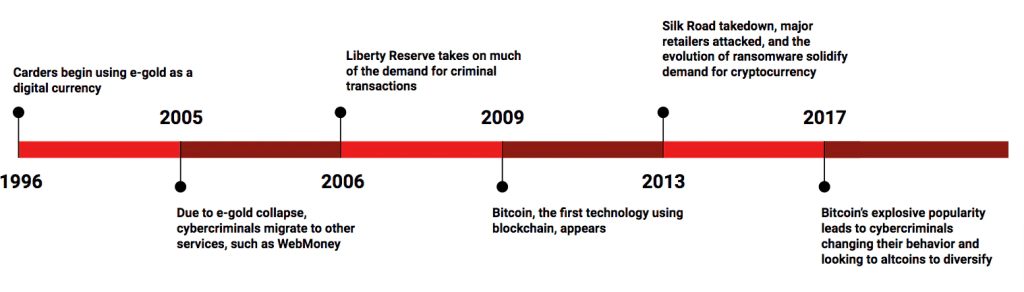

E-gold (Gold & Silver Reserve) – 1996

E-gold was a digital gold currency managed by Gold & Silver Reserve Inc. (G&SR) under the name e-gold Ltd. that allowed users to open accounts on their website in grammes of gold (or other precious metals) and make quick value transfers (“spends”) to other e-gold accounts. The e-gold system was established in 1996 and had expanded to five million accounts by 2009 when transfers were halted due to legal concerns. On a monetary foundation of only US$71 million worth of gold (3.5 metric tonnes), e-gold processed more than US$2 billion in transactions per year at its peak in 2006, on a monetary base of only US$71 million worth of gold (3.5 metric tonnes), indicating a high monetary turnover (velocity) of about 28 times per year (for comparison, the annual velocity of US$ is about 6 for M1 and less than 1.6 for M2). e-gold Ltd. is a company based in Nevis, Saint Kitts and Nevis, having activities in Florida, United States.

The company was founded two years before PayPal, although it did not begin to grow exponentially until the year 2000. There were nearly a million accounts by 2004. It was the first digital currency system to garner substantial user and merchant adoption, with the Financial Times describing it as “the first electronic currency that has gained critical mass on the web” on July 13, 1999. It was also the first non-credit-card payment service provider to provide an application programming interface (API), allowing additional services and e-commerce transactions to be built on top of it.

In February 1999, e-gold provided functionality for wireless mobile payments, following the maiden demonstration of an e-gold Spend via Palm Pilot.

Individuals and merchants used e-gold for a variety of activities, including metals trade, online merchants, online auctions, online casinos, political organisations, and non-profits.

Failed: criminal usage, hackers, fraud and more

It’s possible that E-early gold’s success contributed to its collapse. E-gold was an early target of financial malware and phishing schemes by increasingly organised crime syndicates due to its store of value and massive user base. Starting in 2003, the approach was enhanced with attacks against digital gold systems such as e-gold and then used to attack other financial institutions.

Due to its failure to proactively verify account holders’ identities, e-gold began to see an increase in criminal behaviour against its users, which was primarily conducted by Russian[citation needed] and Ukrainian[citation needed] hackers. In addition to phishing, the attackers exploited weaknesses in Microsoft Windows operating systems and the Internet Explorer web browser to gather account information from millions of machines and breach e-gold accounts.

Various fraud artists from Western countries were also able to use the e-gold system to fund their schemes, making transnational Ponzi schemes possible for the first time in history. Auction fraudsters on eBay would use the platform to sell phoney or non-existent items. These criminal gangs preferred that their victims pay in e-gold since it was the quickest and most convenient way for them to transfer monies internationally.

E-gold was unwittingly contributing to a wider banking systemic crisis. Because the US banking and credit systems were not created for a digital environment, they were inherently insecure and highly prone to identity theft, check fraud and trust-based attacks like phishing.

E-gold’s failure was ultimately due to its inability to provide a trustworthy user identification system, as well as a functional dispute resolution mechanism to detect and stop illegal and abusive behaviour in their user community.

Hashcash (Adam Back) – 1997

Hashcash is a hash-based cryptographic proof-of-work technique that needs a configurable amount of labour to compute yet can be confirmed quickly. A textual encoding of a hashcash stamp is appended to the header of an email for email purposes to prove the sender spent a little amount of CPU time calculating the stamp before sending the email. In other words, because the sender spent effort creating the stamp and sending the email, it’s improbable that they’re a spammer. The receiver can validate the stamp’s validity at a low computing cost. The only known approach to locate a header with the required properties is to use brute force, which entails attempting random values until the answer is found. Though testing an individual string is easy, satisfactory answers are rare enough that it will require a substantial number of tries to find the answer.

Hashcash necessitates the use of potentially large computational resources for each e-mail sent, making it difficult to calibrate the appropriate amount of average time clients should spend generating a valid header. This may imply sacrificing accessibility from low-end embedded devices or risking hostile hosts not being sufficiently pushed to provide an effective spam filter.

Back’s Hashcash was the inspiration for the mining algorithm used in the Bitcoin distributed ledger, according to Satoshi Nakamoto, who mentioned it in the Bitcoin whitepaper. “Rather than newspaper or Usenet articles, we’ll need to employ a proof-of-work system like Adam Back’s Hashcash to create a distributed timestamp server on a peer-to-peer basis.” The proof-of-work entails looking for a value that, when hashed, begins with a number of zero bits, such as SHA-256. The average amount of work required is proportional to the number of zero bits required, and can be tested with a single hash.”

Failed: nodes were also problematic

Email spam was not that big of an issue, despite the volume. The reduction of unwanted emails could be mitigated by the use of heuristic algorithms that learn what is unwanted. Also, hackers were able to take over “commuter” nodes, similar to validator nodes that are used today. Bitcoin and other tokens solve this problem by requiring multiple decentralised nodes to verify the transaction before it is accepted by the network. This is part of the network consensus protocol.

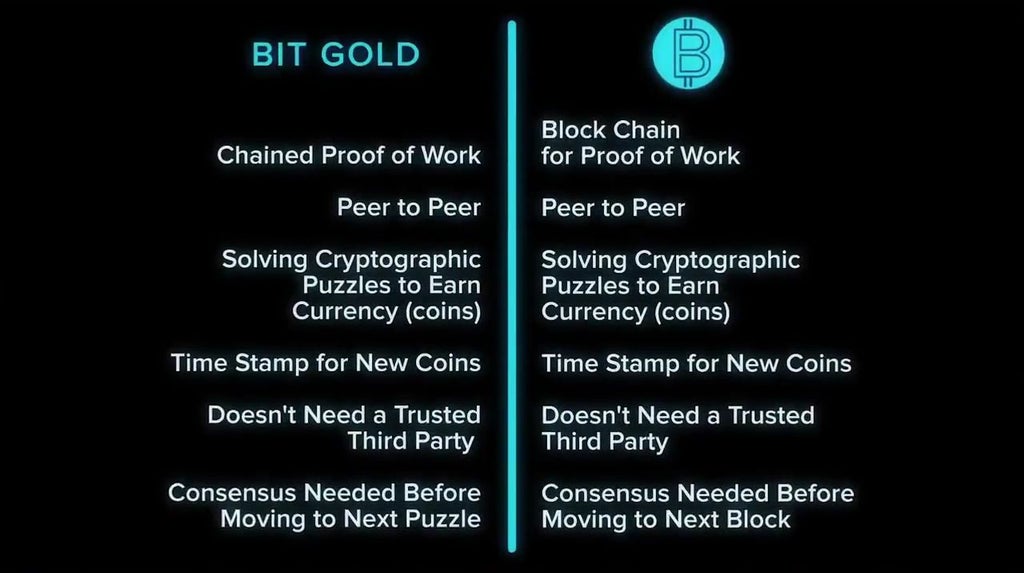

Bit Gold (Nick Szabo) – 1998

Despite the fact that Szabo’s bit gold project was never completed, it is widely regarded as the forerunner to Satoshi Nakamoto’s bitcoin system. In fact, the bit gold and bitcoin protocols are so similar that some have speculated that Szabo is Satoshi Nakamoto, the secretive bitcoin designer (although Szabo has denied this claim).

Bit gold achieves decentralisation by combining parts of cryptography and mining. Time-stamped blocks that are maintained in a title registry and created using proof-of-work (PoW) strings are among these elements. Szabo proposed a decentralised PoW function that could be “securely kept, transferred, and tested with minimum trust,” according to Szabo.

In the bit gold structure, a user must employ processing power to solve a cryptographic challenge. All completed puzzles are sent across a Byzantine Fault Tolerant (BFT) peer-to-peer network and allocated to the puzzle solver’s public key. A title registry keeps track of the transaction’s details (analogous to a blockchain in the consensus system because it offers an immutable record of and order for transactions that have taken place).

Every solution then becomes a component of the next puzzle, forming a chain that connects the solution of the most recent puzzle to the result of the next, validating blocks of transactions. This is analogous to how hash addresses are used as headers in bitcoin’s block creation process, pointing to the next batch of blocks.

Szabo’s planned bit gold system is non-fungible. This means that in order to make a single transaction, different amounts of bit gold should be mixed. The bit gold operates on a decentralised and distributed system of trust amongst the numerous nodes—or participating computers—that make up its network, rather than a centralised authority controlling its levers.

Failed: users need to trust each other

Unfortunately, customers and financial institutions are vulnerable to fraud and theft when they transact through trust-based systems. In reality, Szabo was inspired to propose bit gold, a more trustless mechanism for transacting, by the banking system’s history of consistent losses (and the high expense of this fraudulent behaviour and siloed design). Szabo’s lecture at the 2015 Bitcoin Investor Conference focused on the objective of bit gold: “software to limit vulnerabilities of all parties to each other.”

Bitcoin lacks this disadvantage as it is inherently trustless but chooses the verify each transaction.

B-Money (Wei Dai) – 1998

B-money was first proposed in 1998 by computer scientist Wei Dai as an anonymous, distributed electronic payment system. As a result, it attempted to provide many of the same services and features that modern cryptocurrencies do today.

In 1998, Wei Dai, a computer engineer and University of Washington graduate, published an essay outlining the notion of B-money.

Dai’s b-money concept included a number of features that have since become common among cryptocurrencies, such as the requirement for computational work in order to facilitate the digital currency, the requirement that this work is verified by the community in a collective ledger, and the payment of workers for their contributions. Dai advocated that collective bookkeeping be required to keep transactions structured, with cryptographic methods assisting in transaction authentication.

Two recommendations were included in Dai’s b-money concept. The first, which relied on a proof-of-work (PoW) function to generate b-money, was considered largely impracticable. The structure of many modern-day blockchain systems is better predicted by the second proposal.

Despite the fact that Dai’s work with b-money has been overshadowed by more recent and successful cryptocurrency ventures, he remains a key role in the industry’s early development. In commemoration of Dai’s work and the b-money concept, the smallest unit of ether, the Ethereum network’s digital currency, is termed a “Wei.”

Failed: it was only ever a concept

B-money was never officially released; it merely existed as a concept (the equivalent of a white paper). Dai’s work, on the other hand, did not go ignored. Indeed, about a decade after Dai proposed b-money, Satoshi Nakamoto, the pseudonymous founder of the world’s largest cryptocurrency, reached out to Dai before reaching out to any other developers. Dai backed Nakamoto’s concept alongside other cryptocurrency pioneers such as Nick Szabo and Hal Finney.

Conclusion: Bitcoin’s Innovations

Bitcoin not only incorporates the greatest features of previous initiatives, but it also introduces new ideas that are all its own. The blockchain in Bitcoin was the first successful application of electronic money that was not based on a centralised ledger. Satoshi Nakamoto mentioned this centralization as a significant issue in existing electronic payment systems in Bitcoin’s whitepaper.

A lot of people automatically dismiss e-currency as a lost cause because of all the companies that failed since the 1990’s. I hope it’s obvious it was only the centrally controlled nature of those systems that doomed them. I think this is the first time we’re trying a decentralized, non-trust-based system

Satoshi Nakamoto discussing Bitcoin with the P2P Foundation Forum Post

The decentralised ledger did away with the necessity for a trusted third party to manage the currency, instead of allowing it to be managed by all network participants. To ensure that users could agree on a single state of the ledger and avoid double-spending and other invalid transactions when using a decentralised ledger, a solution to the Byzantine Generals Problem was necessary.

Bitcoin employs a Proof-of-Work mechanism to address this issue. Bitcoin is able to scale consensus without the need for intervention or dispute resolution from a central authority because it uses a customised version of reusable Proof-of-Work. Although Hal Finney developed prototypes for this notion in 2004, Bitcoin was the first effort to properly implement it.

Bitcoin’s difficulty adjustment is another factor that helps the Bitcoin network to function without the oversight of a central authority. The Bitcoin network may automatically modify the degree of difficulty associated with mining a single block thanks to this new notion.

The difficulty is adjusted according to on the rate at which miners create new blocks. Bitcoin may ensure that new coins are mined at a predetermined rate by altering the difficulty of mining, independent of the amount of processing power in the network. This automatic adjustment makes the network extremely stable and scalable, without the risk of hyperinflation or a security breach.

Finally, Bitcoin pioneered the concept of blockchain immutability, which ensured that previous network transactions could not be altered. Every new block is added to the end of the old blockchain, solidifying previous transactions even more.

Rewriting the whole block containing the transaction, as well as any following blocks, would be the sole way to amend a previous transaction. Furthermore, the malicious actor would have to generate new blocks to append to the changed block. To catch up and construct the new longest chain, this actor would have to create new blocks at a faster rate than the rest of the Bitcoin network.